Project Goal

To understand consumer behavior and identify obstacles when it comes to debit card use in order to facilitate and improve banking experience.

Questions

- Do consumers use a debit card and why or why not?

- How often do consumers use a debit card?

- What do consumers use instead of a debit card?

- Why does a user use or not use a debit card?

- Based on the number of people who don’t use debit cards, is there an opportunity to increase debit card usage among consumers?

Process

Design

- Survey created using Qualtrics

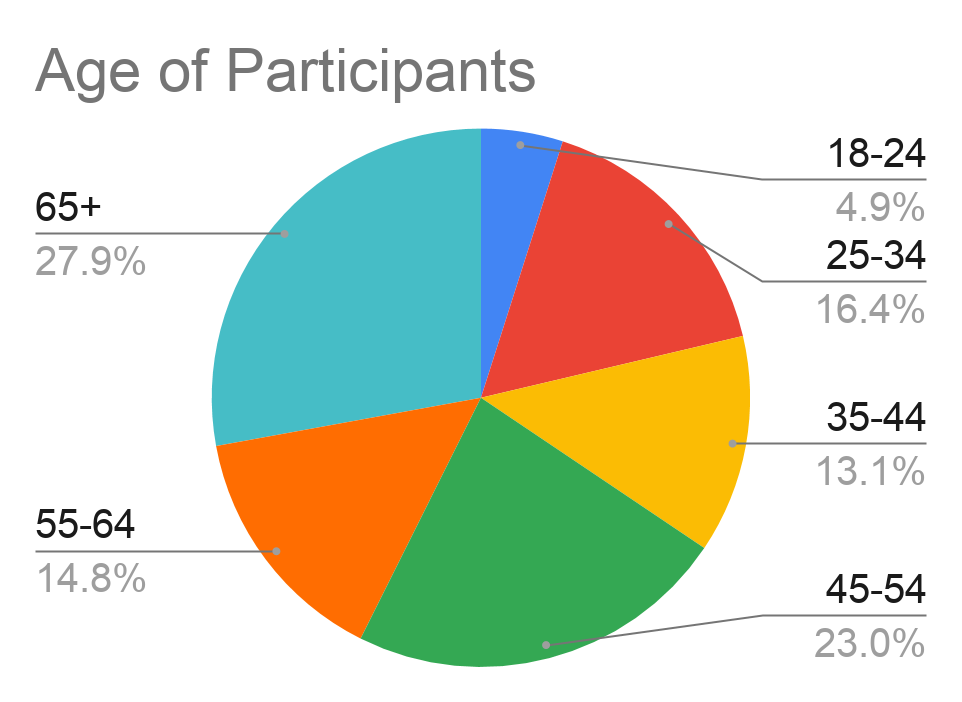

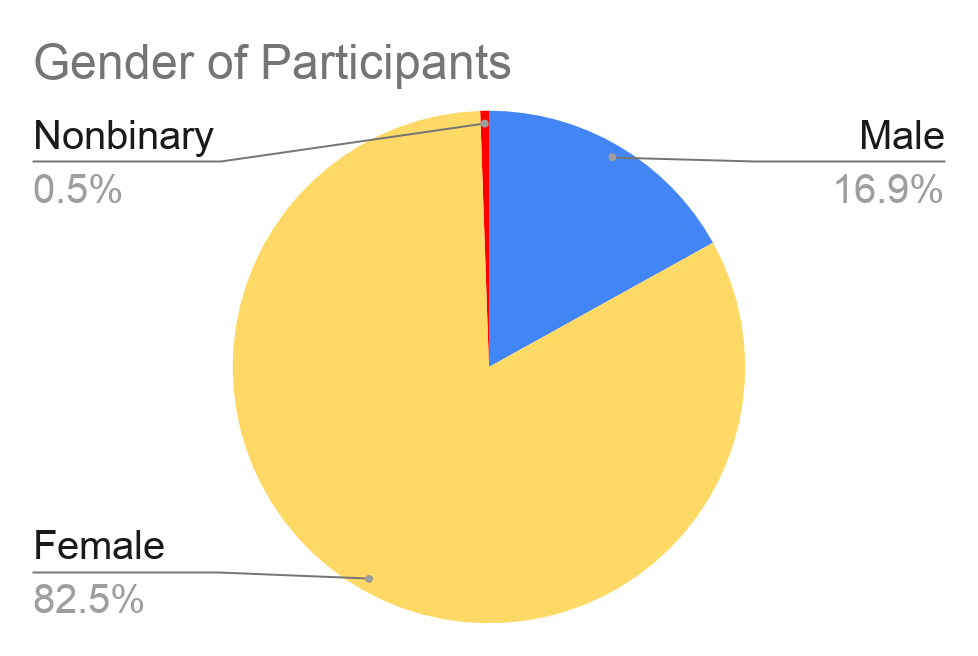

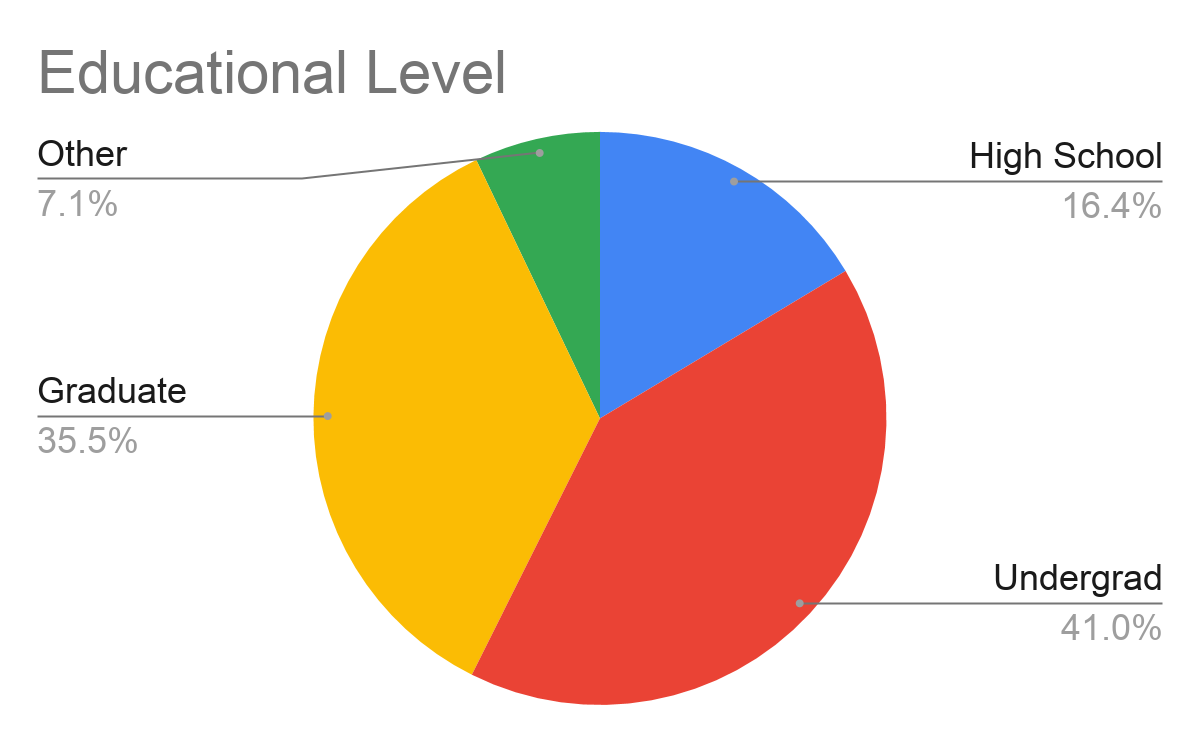

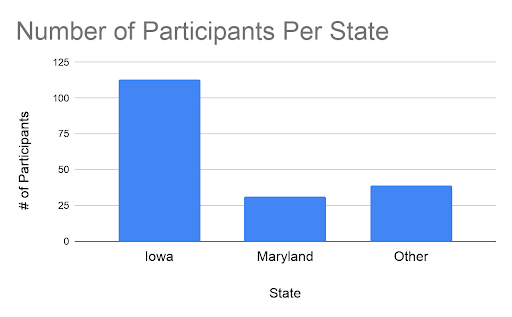

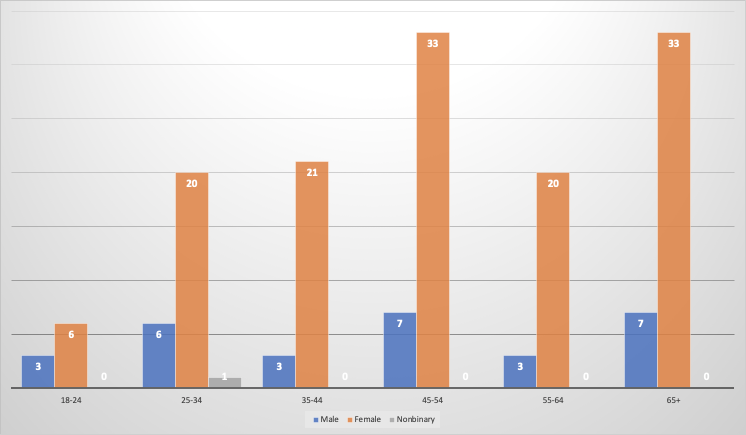

- 4 Demographic Questions

- Two categories (yes or no)

Recruitment

- Text Message

- Social Media

Criteria

- Have a banking account

- Over the age of 18

- Lives inside the US

Results & Findings

Do you prefer to use an ATM or In-person banking?

83%

Perfer to use an ATM

- Convenience

- No Contact with people

17%

Perfer In-Person Banking

- Interaction with people

- Safety

Reasons for NO

70%

I prefer to use other forms of payment

Cash is King; Habit Don’t See the Need for it

- Like to Keep Track of Checking Balance in Checkbook

- Prefer Current Methods

- Low Transaction Fees

20%

Security Concerns

If an issue would arise it is not easy to resolve. Credit cards will reverse unauthorized charges and help fight fraud

- Less Secure than Credit

- Not Insured against Theft

- Not Great at Tracking Spending

- Don’t feel safe using ATM

10%

Other

Cash back and rewards from credit card

- No Cash Rewards

- I like it not to Come out of my Account right Away

- Credit Card let’s me Wait up to a Month to Pay

Insights & Recommendations

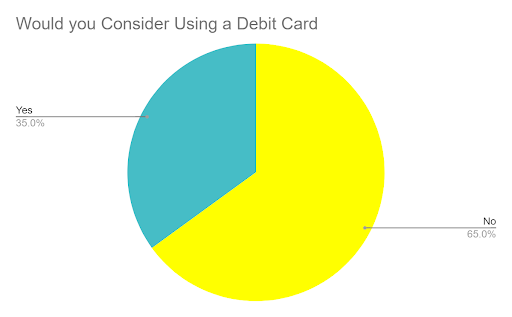

Potential Debit Card Users

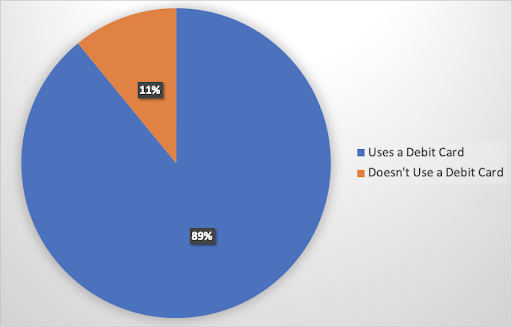

- 11 % of the people that we surveyed said that they do not use a debit card

- One third of those people said they would consider using a debit card

Recommendation

- Capital One can market their debit card program to the small market of users who would consider using a debit card

- Capital One could also address the concerns and offer assurance about the debit card

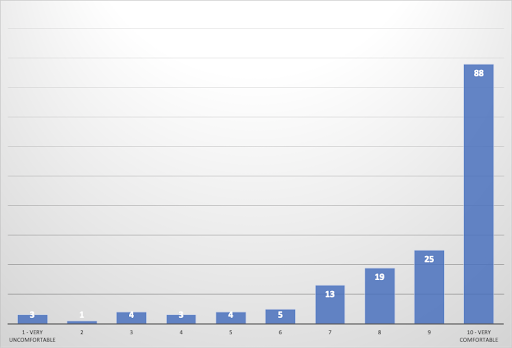

Security

- People think debit card are not insured against theft

- In some cities and towns they don’t feel safe using ATMs

- People feel safer inside the bank, some of them even prefer using the ATMs inside the bank

Recommendation

- Educate consumers on current debit card protection plan and banking security features

- Further research ways to make consumers feel safe when using a debit card or withdrawing money from the bank. One possible question to be answer could be: Why does the inside of the bank make them feel safer?

Social Behavior

- One group of people prefers to use the teller line for transactions because they prefer human interactions and don’t trust in machines

- Other people like that there is no need to talk with someone when using the ATM

- ATM’s are a good option during this pandemic since there is less human contact

Recommendation

- Invest in digital tellers to give the user a choice

- Human interaction of talking with a teller via video chat (no physical contact, but the option of teller services)

- hybrid (digital/no-contact & actual humans inside of the bank)

Education

The lack of knowledge about features and sources available makes people think:

- Debit card are not insured against theft or fraudulent transactions

- They can’t withdraw small bill from the ATM

- Debit card are not insured against theft or fraudulent transactions

Recommendation

- Develop opportunities to educate consumers on how easy it is to use a debit card

- Further research, consumer security concerns and develop new ways to educate consumers

Incentives

- Originally we believed that cash would be our competition, but most of the participants who preferred not to use a debit card, preferred to use a credit card because of the rewards and benefits

- Some participant don’t use the ATM because of the fees

Recommendation

- Incorporate rewards such as earning cash back on purchases when using a debit card

- Promote existing perks of using a debit card such as no fees for withdrawing money and zero overdraft fees